The tanking stock market spells bad news for millions of individual and institutional investors, but its effects will be felt by everyone if the market fails to rebound quickly. Nowhere will the losses be felt harder that in public pension funds, which are heavily invested in Wall Street.

The tanking stock market spells bad news for millions of individual and institutional investors, but its effects will be felt by everyone if the market fails to rebound quickly. Nowhere will the losses be felt harder that in public pension funds, which are heavily invested in Wall Street.

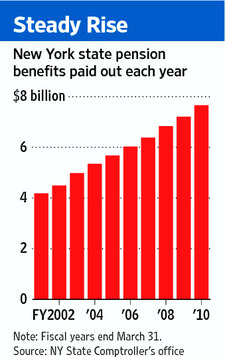

State pension funds, which are estimated to be $3 trillion in debt already, have to make payments to retirees. They are constitutionally guaranteed. When the funds fall short — when investment targets fail to meet their mark — local governments have to make up the difference. In New York, that generally means an increase in property taxes. Close watchers of New York politics will remember that New York passed a “property tax cap” last year, but many may not know that rising pension costs were exempted from the bill.

Still, faced with soaring pension costs coupled with tax protests, town, village, and county officials throughout the country will have no choice but to further cut discretionary services like educational programs, senior centers, and infrastructure repairs. Former New York State comptroller candidate Harry Wilson, a super-smart guy who led the restructuring of General Motors, warned of this extensively in his campaign last year.

Even before today’s market crash, pension costs for New York’s local governments were scheduled to be 37% higher in 2012, squeezing the life out of local government budgets. What’s happening now, in the wake of the S&P U.S. credit downgrade, will only make things worse.

New York State Comptroller Tom DiNapoli gamely predicted today a quick stock market recovery. For everyone’s sake, let’s hope he’s right, but not bet any more on it.

The article you link to cites a $1T gap, not $3T. But what’s a $2T mistake among friends? What your link is right about though is why the pensions have these problems and that’s because they were under funded. Who under funded them? Being the cynic that I am, I immediately assumed it was a Republican. What Republican held office in NY in the critical terms leading up to our current problem? You guessed it, Governor George Pataki. Typical Republican proponent of the starve the beast philosophy that has gotten us into this mess. When will you guys ever learn?

From 1995 —

http://www.nytimes.com/1995/07/06/nyregion/comptroller-sues-to-block-pataki-pension-fund-plan.html

From 2004 —

http://www.nytimes.com/2004/01/20/nyregion/hevesi-rejects-pataki-pension-fund-plans.html