There’s an old political adage: Anyone who robs Peter to pay Paul can always rely on Paul’s vote. The operative question, though, for the long-term health of the country is, are there more Peters or Pauls out there? Because if there are more Pauls than Peters, we’re in trouble.

There’s an old political adage: Anyone who robs Peter to pay Paul can always rely on Paul’s vote. The operative question, though, for the long-term health of the country is, are there more Peters or Pauls out there? Because if there are more Pauls than Peters, we’re in trouble.

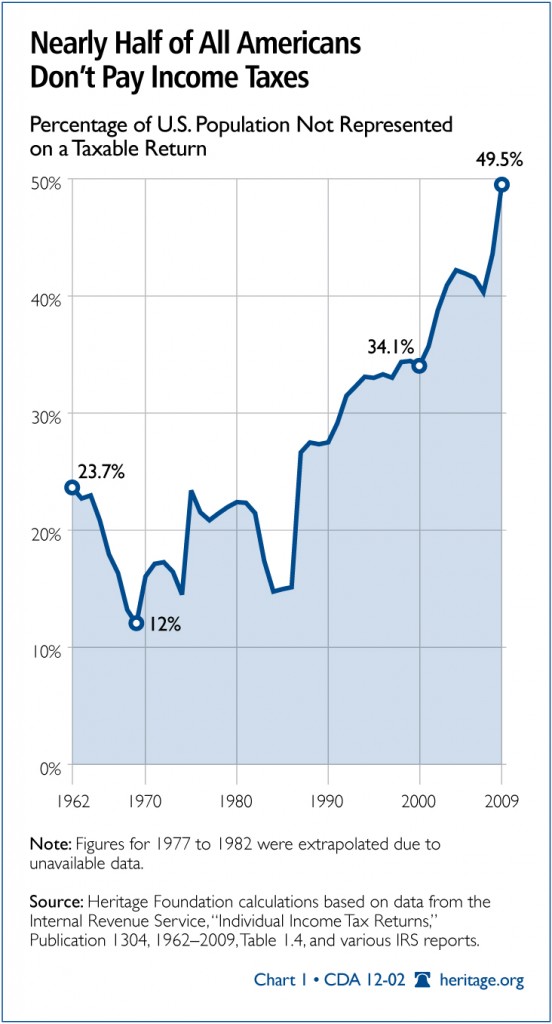

Turns out it’s a good time to ask the question. The Heritage Foundation reports new data today showing that 49.5% of Americans now pay no income tax, up from 14% in the early years of the Reagan presidency. In other words, the critical mass — the balance between Peters and Pauls — is about to shift into negativity territory. The number of people taking money from the federal government without putting any in is about to exceed those kicking into the federal coffers. That’s a bit of a freak out.

What it suggests is that a politician in a median district will soon lose any electoral incentive to keep tax rates reasonable or to work to control federal spending. If 51% — or 61% — of voters are the beneficiaries of one’s legislative munificence, that patron politician will, in all likelihood, have continual electoral success. The U.S. is already borrowing 42 cents on every dollar it spends; one shudders to think how much worse it could get should Pauls become a significant majority.

This also means that more Americans are failing to meet the income threshold for paying federal income tax. That’s equally depressing.

A theoretical (for now) question. Should the balance between Peters and Pauls one day go to 70-30 Paul, or even, God forbid, 80-20, will the Left still be able to argue with a straight face that the minority aren’t paying their “fair share?”

Leave a Reply